<- Return to FTA Home Page | <- Return to FTA Tax Rates Page

click here to View Presentations on Marijuana Taxation Issues form FTA Conferences

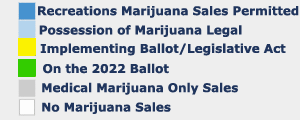

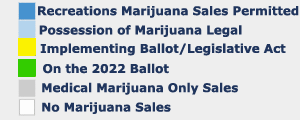

Click on Blue/Yellow States to View Details of State Programs, or

Source: Federation of Tax Administrators from various sources

Updated - November 17, 2022

Legalization was approved with Ballot Measure 2 in 2014. The first cultivation license was granted in July 2016, with retail sales beginning in October 2016

Taxes:

FY 2017 Revenues $1.7 million.

Agencies Administering:

Licensing and Tracking: Marijuana Control Board

https://www.commerce.alaska.gov/web/AMCO

Tax Administration: Alaska Dept. of Revenue

http://tax.alaska.gov/

Arizona Proposition 207, Marijuana Legalization Initiative approved on 2020 Ballot [59.9% to 40.1%]. Licensing of Retail establishments began January 16, 2021

Taxes:

Agencies Administering:

The Arkansas Marijuana Legalization Initiative was defeated [44%-56%] in Arkansas as an initiated constitutional amendment on November 8, 2022. Votes on the initiative may not be counted pending a supreme court ruling.

The initiative would legalizing the possession and use of up to one ounce of marijuana for persons who are at least 21 years old, enacting a 10% tax on marijuana sales, and requiring the state Alcoholic Beverage Control Division to develop rules to regulate marijuana businesses. Under the amendment, businesses that already hold licenses under the state's medical marijuana program would be authorized to sell marijuana. An additional 40 licenses would be given to businesses chosen by a lottery.

Legalization was approved with Proposition 64 in 2016. Personal use and growth were legal beginning in November 2016. Retail sales began January 2018

Taxes:

notes, medical marijuana was exempted from the state sales tax on November 2016 by Prop. 64.

FY 2018 Revenues (two quarters) $134 million.

Agencies Administering:

Tracking and Licensing: Dept. of Cannabis Control

https://cannabis.ca.gov

Tax Administration: California Dept. of Tax and Fee Administration

https://www.cdtfa.ca.gov/

Legalization began when voters approved Constitutional Amendment 64 in 2012. Colorado became the first state to begin legal sales when retail stores opened in January 2014.

Taxes:

FY 2018 State Revenues $251 million.

Agencies Administering:

Tracking, Licensing and Taxes: Colorado Dept. of Revenue

https://www.colorado.gov/pacific/enforcement/marijuanaenforcement

Revenue and Sales Data

https://www.colorado.gov/pacific/revenue/colorado-marijuana-sales-reports

https://www.colorado.gov/pacific/revenue

The Governor has sign SB 1201 providing for the possession and retail sales of recreational marijuana. Possession of up to 1.5 ounces will be allowed beginning July 1, 2021. Retail sales are expected to begin by the end of 2022

Taxes:

Agencies Administering:

Tracking, Licensing and Taxes: Connecticut Department Consumer Protection

https://portal.ct.gov/DCP

Tax Collections: Connecticut Department of Revenue Services

https://portal.ct.gov/DRS

Voters approved Ballot Initiative 71 in 2014 that allowed possession of less than two ounces of marijuana. However, Federal law does NOT permit the cultivation, distribution and retail sales of Marijuana.

Bipartisan bill H.B. 1438, which the General Assembly passed May 31, will allow adults 21 and

older to buy marijuana from licensed dispensaries started January 1, 2020. Pritzker signed the

bill June 25, 2019.

Taxes:

Agencies Administering

Tracking and Licensing [Illinois Dept. of Financial & Professional Regulation]

https://www.idfpr.com/ILCannabis.asp

Taxes: Illinois Dept. of Revenue Cannabis Information Page -https://www2.illinois.gov/rev/

Information bulletin 2020-12

Voters approved marijuana legalization with the Ballot Question 1 in 2016. This allowed possession and individuals to grow marijuana beginning on January 30, 2017. On May 2, 2018, the Legislature overrode the Governor's veto of LD 1719, An Act to Implement a Regulatory Structure for Adult Use Marijuana. Retail sales began on October 9, 2020.

Taxes:

Agencies Administering:

Tracking and Licensing: Office of Marijuana Policy - Maine Department Administrative and Financial Services

https://www.maine.gov/dafs/ [draft rules released - April 23 2019]

Taxes: Maine Revenue Service

https://www.maine.gov/revenue/

The voters approved Question 4 [67%-33%] on the November 2022 ballot to amend the constitution, which would legalize marijuana for adults 21 year of age or older beginning in July 2023 and direct the Legislature to pass laws for the use, distribution, regulation and taxation of marijuana.

Legalization was approved with Ballot Question 4 in 2016. While the ballot question set January 2018 as the date for retail sales to begin, legislation H 3818 delayed first sales until after July 1, 2018 and set various tax rates. It also created a Cannabis Control Commission with 5 appointed members.

The first cultivation license was issued on June 21, 2018, and the first retail store openned on November 20, 2018.

Taxes:

Agencies Administering:

Tracking and Licensing: Massachusetts Cannabis Control Commission

https://mass-cannabis-control.com/

Taxes: Massachusetts Dept. of Revenue

https://www.mass.gov/marijuana-retail-taxes

Voters recently approved Ballot Proposal 1 in the 2018 election authorizing the cultivation, distribution and retail sales of recreational Marihuana. State policymakers now need to approve legislation to implement the proposal. Details on taxes and regulation will be spelled out in future legislation. Legal retail sales began on December 6, 2019.

Taxes:

Agencies Administering:

Tracking and Licensing: Michigan Dept. of Licensing and Regulatory Affairs

https://www.michigan.gov/lara/0,4601,7-154-89334_79571_90056---,00.html

Taxes: To Be Administered by the Michigan Department of Treasury

https://www.michigan.gov/treasury

The Department has recently released Bulletin 2019-17 discussing collections of retail excise tax.

Voters, on the November 20222 ballot, approved [53%-47%] Amendment 3 titled the Marijuana Legalization Initiative. The initiative would legalize the purchase, possession, consumption, use, delivery, manufacturing, and sale of marijuana for personal use for persons who are 21 years old or older; allow individuals convicted of non-violent marijuana-related offenses to petition to be released from incarceration and/or have their records expunged; and impose a 6% tax on the sale of marijuana.

Montana I-190, Marijuana Legalization and Tax Initiative approved on the 2020 ballot [56.6% to 43.4%]. Retail sales to began January 2022.

Taxes:

Agencies Administering:

The Montana Department of Revenue would be responsible for regulating the cultivation, manufacture, transport, and sale of marijuana in Montana. https://mtrevenue.gov/

Legal sales of Marijuana were approved by the voters with Ballot Question 2 in 2016. While the Ballot Question setup January 1, 2017 as the start date for retail sales, the Dept. of Taxation approved regulations allowing sales to begin on July 1, 2017. Due to supply conditions, the Department temporarily permitted medical facilities to sell recreational marijuana.

Taxes:

Agencies Administering:

Tracking, Licensing and Taxes: Nevada Dept. of Taxation

http://marijuana.nv.gov/

The Governor recently sign HB 2 which provides for the retail sales of recreational marijuana began April 2022.

Taxes:

Agencies Administering:

New Jersey Marijuana Legalization Amendment was approved on the 2020 ballot [66.9% to 33.1%].

Retail sales began April 21, 2022.

Taxes:

Agencies Administering:

The legislature has approved and the Governor signed S. 854 which allows for recreational marijuana sales scheduled to beginn April 1, 2022. [has not started]

Taxes:

Agencies Administering:

In November 2022, North Dakota voters defeated [45%-55%] an initiated state statute which would legalize the use and possession of up to one ounce of marijuana. The measure would require the Department of Health and Human Services, or another department or agency designated by the state legislature, to establish marijuana regulations, including for the production and distribution of marijuana by October 1, 2023. Under the measure, the department could license seven cultivation facilities and 18 marijuana retailers.

Voters approved Initiative Measure 91 in 2014 that legalized recreational marijuana allowing possession of up to 8 ounces and four plants. It also required the Liquor Control Commission to regulate sales. Legislation was approved in the 2015 session that allowed retail sales to begin on October 1, 2015, initially through medical dispensaries on a temporary basis. Recreational marijuana retail licenses were granted beginning October 1, 2016.

Taxes:

Agencies Administering:

Tracking and Licensing: Oregon Liquor Control Commission

https://www.oregon.gov/olcc/Pages/index.aspx

Taxes: Oregon Dept. of Revenue

https://www.oregon.gov/DOR/Pages/index.aspx

The Governor sign legislation [H 7593/S 2430] to allow the retail sales of recreational marijuana. While regulations still need to be written, retail sales are scheduled to begin December 1, 2022

Taxes:

Agencies Administering:

Tracking and Licensing: Rhode Island Cannabis Control Commission (to be created)

Taxes: Rhode Island Division of Taxation

https://tax.ri.gov

On November 8, 2022, voters decided against Measure 27 [47%-53%], which would have legalize the possession, distribution and use of marijuana for persons who are at least 21 years of age.

Previously, South Dakota Constitutional Amendment A, Marijuana Legalization Initiative was approved on the 2020 ballot [53.4% to 46.6%]. NOTE: Constitutional Amendment A was declared invalid on November 24, 2021. A separate provision for Medical Marijuana Legalization still goes into effect.

The amendment would require the South Dakota State Legislature to pass laws providing for a program for medical marijuana and the sale of hemp by April 1, 2022.

Taxes:

In September, the legislature approved S. 54. If signed by the governor, this bill would authorize Retail Sales of recreational marijuana begining October 1, 2022. The provisions of S. 54 are below.

Taxes

Agencies Administering:

Previous Actions:

In January 2018, the governor signed H. 511 permitting the possession of 1 ounce of marijuana and two plants. It did NOT allow the retail sales of marijuana but created a Marijuana Advisory Commission which would submit recommendations to the legislature on future retail sales.

Agencies Administering:

Vermont Marijuana Advisory Commission

https://marijuanacommission.vermont.gov/

The legislature approved and the governor signed SB 1406 [HB 2312] which legalizes possession and allows for the retail sales of Marijuana. Legal possession of of one ounce or less will be allowed July 1, 2021, while retail sales will begin January 1, 2024.

Taxes:

Agencies Administering:

Virginia Cannabis Control Authority https://www.cannabis.virginia.gov

Voters approved Measure Initiative 502 in 2012 which legalized the possession, distribution and sales of marijuana. It required the State Liquor Control Board to regulate and tax the retail sale of Marijuana. Legislation in 2015 (H 2136) changed the tax rate (from 25% wholesale and retail tax) to the current 37% rate and changed the name to the Washington State Liquor and Cannibas Board.

Retail sales began July 2014, with Washington became the second state to permit retail sales of recreational marijuana. Note, medical dispensaries were required to obtain a retail license after June 2016.

Taxes:

Agencies Administering:

Tracking, Licensing and Taxes: Washington State Liquor and Canabis Board

https://lcb.wa.gov/

Information on past and future Ballot Initiatives.

https://ballotpedia.org/Marijuana_on_the_ballot#By_year

Source: Federation of Tax Administrators from various sources

Updated - November 17, 2022